Restaurant EMV Terminals for Any Processing Platform

Expand your payment acceptance capabilities by upgrading to an EMV (Europay, MasterCard, and VISA) terminal. Restaurant EMV terminals offered through Evergreen Point of Sale allow you to securely and efficiently accept EMV chip card payments. EMV terminals enables your restaurant to comply with the new standard for payment processing, protect your business from fraudulent charges, and align with a growing consumer expectation to use EMV chip cards.

Restaurant EMV terminals from Evergreen Point of Sale are also enabled for near-field communication (NFC) contactless payment methods like Apple Pay and Android Pay to give your customers even more choices.

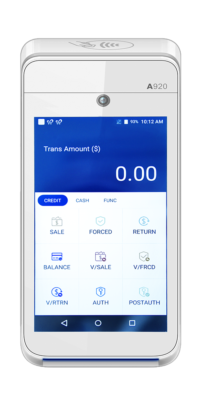

Supported Devices

Why is EMV right for me?

Partnerships that Support EMV Acceptance at Your Restaurant

Rely on the experts at Evergreen Point of Sale to provide you with a comprehensive EMV solution that supports your payment and tipping processes, that’s quick and easy to use, and that makes settling the check convenient for your guests. With options that serve the unique way you do business, contact Evergreen Point of Sale for a no-obligation consultation to determine if EMV readers are right for you.

In October 2015, Visa, MasterCard, Discover and American Express mandated liability shifts for fraudulent transactions. This means that merchants using legacy magnetic stripe readers for accepting credit cards carry the entire burden for merchant chargebacks if a card with a chip is swiped. While EMV payment terminals are typically more expensive to purchase than magnetic stripe readers, it’s important to weigh the upfront cost against the potential long term cost of paying for customer initiated chargebacks. Many consumers will prefer using merchants capable of processing EMV transactions because EMV advertises an enhanced level of payment security.